The UK property investment landscape changed dramatically in recent years. In the first half of 2025 alone, 33,598 new buy-to-let limited companies were established

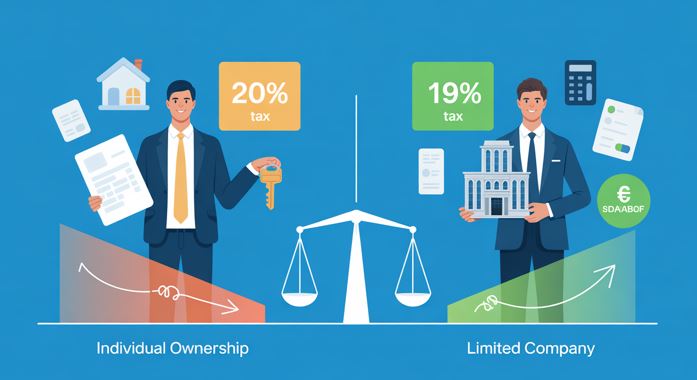

Investors in Real Estate can either invest individually or via a Limited Liability Company Tax. Law changes enacted in recent years have made the second choice more popular. Each type of property ownership has unique tax consequences, with benefits and disadvantages associated with each structure. The right option is based on your business objectives. In this guide, we’ll break down the key differences, explain which structure suits different investor profiles, and show you exactly how to make the right decision for your portfolio.

Ownership Structure: Individual vs. Limited Company

When investing in property, choosing the right structure is crucial for optimizing your investment. Should I invest in my name or through a limited company, this is one of the most common questions property investors ask. Like all things related to taxes, the answer is “it depends. Your property investment goals will lead this decision.

Are you planning to?

- Build a portfolio to generate passive rental income.

- Increase property values, sell it at a gain, and reinvest?

- Invest life savings into real estate as part of a retirement plan.

However, there are two primary methods to invest as an individual or partnership, or as a shareholder in a company. A clear objective from the outset will allow the company ownership structure to work for your long-term goals.

Individual Ownership: How It Works

When you buy property in your personal name (or as a partnership), rental income is added to your other income and taxed at your marginal rate.

You can claim actual expenses like repairs, maintenance, agent fees, and insurance. Also, individual ownership has lower entry costs due to no company setup fees or annual.

However, all rental income is taxed immediately, even if reinvested and also, your personal assets are at risk if things go wrong.

Limited Company Ownership: How It Works

When you buy property through a limited company, the company is the legal owner. Rental income belongs to the company and is subject to corporation tax, not personal income tax. Mortgage interest and financing costs are fully deductible as business expenses. Profits can be retained in the company for reinvestment at corporation tax rates. Extracting profits via dividends or salary triggers additional personal tax.

However, limited company ownership requires annual accounts, corporation tax returns, companies House filings, and higher accountancy fees.

Limited Company vs Personal Ownership: Quick Comparison

| Factor | Personal Ownership | Limited Company |

|---|---|---|

| Mortgage interest relief | 20% tax credit only | Fully deductible |

| Income tax on rental profit | 20-45% | 19-25% corporation tax |

| SDLT surcharge | 3% (if 2nd property) | Always 3% |

| Profit extraction | Direct access | Taxed as dividend/salary |

| Setup complexity | Simple | Requires company formation |

| Annual compliance | Self-Assessment only | Accounts + Corporation Tax + Self-Assessment |

| Mortgage availability | Wide choice | Fewer lenders, higher rates |

| Asset protection | No separation | Limited liability |

| Best for | 1-2 properties, income reliance | Portfolio growth, reinvestment |

Who Should Use Individual Ownership?

Individual ownership makes sense if you have 1-2 properties with low or no mortgage debt, are a basic-rate taxpayer (earning under £50,270), need immediate access to rental income for living expenses, want simplicity with minimal admin, or plan to sell properties within 5 years (to utilize CGT annual exemption).

Example: A basic-rate taxpayer owns one mortgage-free buy-to-let generating £12,000 annual rental profit. Tax due: £2,400 (20%). Setting up a limited company would add complexity and accountancy costs without meaningful tax savings.

Who Should Use Limited Company Ownership?

Limited company structure is ideal if you’re a higher or additional-rate taxpayer (40-45% tax bracket), have 3+ mortgaged properties or plan to build a portfolio, want to reinvest profits rather than extract income immediately, are comfortable with increased admin and compliance requirements, or value asset protection and limited liability.

Example: A higher-rate taxpayer owns 5 buy-to-lets with £200,000 annual rental income and £120,000 mortgage interest. As an individual, tax liability would be £32,000+. Through a limited company with full mortgage interest deduction, corporation tax is approximately £15,200—saving £16,800 annually.

How Reflex Accounting Helps Property Investors

At Reflex Accounting, we’ve specialized in UK property taxation for over 10 years, helping landlords and investors navigate these complex decisions.

What We Do for Property Investors:

Tax compliance: Self-Assessment tax return for individuals, corporation tax returns for companies, limited company accounting and tax planning, and HMRC audit protection.

Bookkeeping & accounts: Monthly income/expense tracking, quarterly profit reports by property, and statutory accounts for Companies House.

Strategic advice: Portfolio growth planning, mortgage interest optimization, profit extraction strategies, and inheritance tax mitigation.

Case Study: A higher-rate taxpayer with 4 mortgaged buy-to-lets was paying £18,000 annually in income tax. After restructuring into a limited company with Reflex, their effective tax rate dropped to 19%—saving £11,400 per year while retaining profits for reinvestment.