Selling a property in the UK can be great financially, but it also comes with important tax responsibilities. Many property owners understand they need to pay tax when they make a profit. But the real challenge lies in knowing exactly how to report and pay capital gains tax on the UK property correctly and on time. This complete guide explains what capital gains tax on UK property is, how CGT reporting works and how to pay capital gains tax online.

What is Capital Gains Tax on Property?

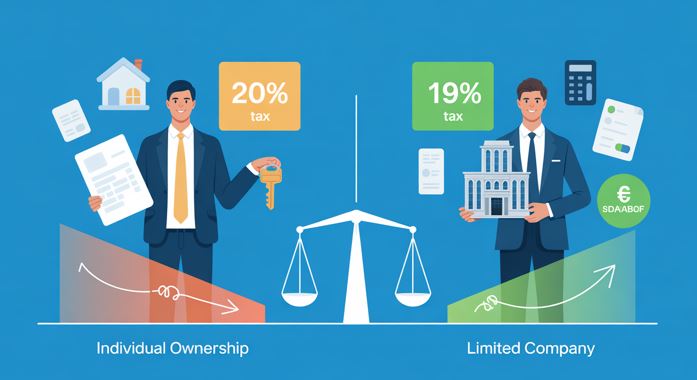

Capital gains tax is charged on the profit that you make by selling or disposing of a property that isn’t your main residence. The gain is calculated as the difference between buying value and selling price, after deducting allowable costs like acquisition, selling fees and qualifying improvements. For residential properties, CGT rates are currently 18% for basic-rate taxpayers and 24% for higher-rate and additional-rate taxpayers on gains above the annual exempt amount. The annual exempt amount (AEA) remains £3,000 for individuals in the 2025/26 tax year while gains up to this level are tax-free. According to recent HMRC data, 163,000 taxpayers filed CGT on the UK Property returns, reporting 183,000 disposals and £10.3 billion in gains and £2.2 billion in CGT liability.

Who Needs to Report Capital Gains?

UK residents must report capital gains on residential property disposals if taxable gains go above reliefs and the £3,000 AEA. Non-residents must report all UK property disposals, even with no tax due. If your gain is completely covered by Principal Private Residence (PRP) relief, you may not need to report. The market value of inherited properties is calculated at the time of inheritance as the base cost, often minimising gains on quick sales.

The 60-Day CGT Reporting Rule

The 60-day CGT reporting deadline is a key requirement for UK residential property disposals by residents and all UK property by non-residents. You must report capital gains within 60 days and pay capital gains tax online within the same timeframe. This requirement is known as 60-day CGT reporting and applies even if you normally submit a Self-Assessment tax return. It was implemented on 6 April 2020. Missing the deadlines can lead to fines, interest and unnecessary complications. Many property owners assume they can wait until January each year. But the rules are clear, and HMRC expects an early and separate CGT return for disposals of residential property.

How to Report Capital Gains Tax on the UK Property

To comply with HMRC’s requirements, you must complete a dedicated capital gains tax return for the UK property online. It includes the following process:

- Calculate the Gain

Deduct acquisition cost, allowable expenses and reliefs from the sale price. - Create a CGT Account

Register on GOV.UK with your Government Gateway ID for the CGT on the UK property service.

- File the Return

Submit details through HMRC’s digital portal with dates, sale proceeds, allowable costs and reliefs. Paper options exist for those who are unable to file digitally.

- Amend as required

Update for final income figures or additional losses through the service or Self Assessment.

- Pay the Tax

HMRC will confirm the amount of tax due and provide a reference that you must use to pay the tax.

How to Pay Capital Gains Tax in the UK

Once your capital gains tax return has been filed, you must pay capital gains tax online within 60 days of the completion date using the provided 14-digit reference code. Payments can be made through debit card, bank transfer or online banking. You must use the correct reference to avoid delays or misallocated payments. Instalments are possible for gifts or deferred proceeds. Overpayments are refunded with interest. Prompt payments complete your compliance and protect you from penalties for late payments or filings.

What happens After You have Reported and Paid CGT

After submitting your CGT on the UK property report and paying the tax, you may still need to include the disposal on your annual Self Assessment return. HMRC’s systems are increasingly interconnected. They use data from multiple sources to cross-check property sales with filings like Land Registry information. If any figures were the estimates at the time of initial reporting, they should be corrected later to ensure accuracy.

Exemptions, Reliefs and Self Assessment Integration

There are ways which help reduce liability, such as:

- Principal Private Residence Relief: it can be a full or partial exemption for main homes.

- Losses: Offset against current gains.

- Other reliefs: like Business Asset Disposal Relief

Why Professional Support Matters

CGT reporting can be more complex than it first appears. Joint properties, inherited assets, mixed-use homes and partial reliefs can all affect how much tax is due and how you report and pay capital gains tax on the UK property compliantly. Many property owners also overlook legitimate deductions or reliefs that could reduce their overall liability.

With specialist support from Reflex Accounting, a firm experienced in UK property investment accounting and taxation, you can manage CGT obligations with confidence. We work closely with property investors and landlords to prepare accurate CGT returns, ensure HMRC deadlines are met, optimise tax positions, and minimise the risk of penalties—allowing you to focus on your property portfolio with peace of mind.

Faqs:

Do you need to report capital gains if under the allowance?

If your total capital gain is completely covered by your annual CGT allowance and no tax is payable, you generally do not need to submit a 60-day CGT property return as a UK resident. However, if you have already completed a Self Assessment tax return, the disposal may still need to be declared there. Non-UK residents must report UK property disposals even if no tax is due.

What is the annual CGT exemption for 2025/26?

For the 2025/26 tax year, the annual CGT exemption is £3,000 per individual. Any gains above this amount may be subject to capital gains tax, which depends on your overall income and circumstances.

What is the 60-day CGT reporting rule?

The 60-day CGT reporting rule requires you to report and pay capital gains tax on UK residential property within 60 days of completion if a tax liability arises. This is done through HMRC’s online CGT service and is separate from the annual Self Assessment return.