Holding companies have become increasingly popular among UK entrepreneurs looking to protect assets, streamline operations, and optimise tax efficiency. By owning and controlling subsidiary businesses without engaging in day-to-day trading, a holding company creates a powerful structure that shields valuable assets from operational risks while unlocking significant tax benefits.

In this guide, we’ll walk you through everything you need to know and what a holding company is, its key benefits, the step-by-step setup process, and how to create a tax-efficient structure for your business.

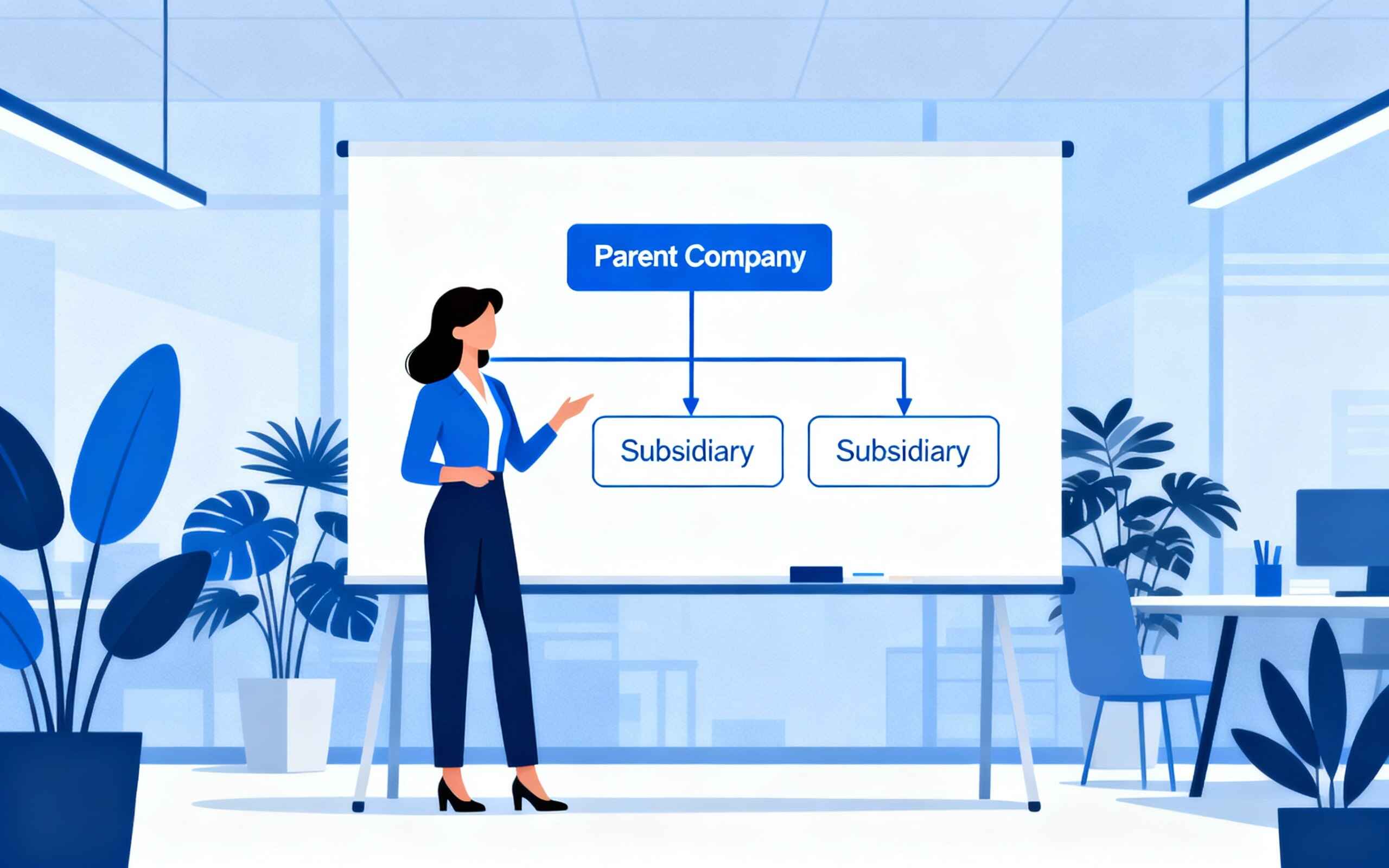

What is a Holding Company?

A holding company is a business entity that mainly owns other companies or assets. It doesn’t typically engage in daily business activities but manages its subsidiaries instead. Think of it like the head of a family tree, with each subsidiary as a branch.

There are two main types of holding companies:

Pure Holding Company

Only exists to control subsidiary companies.

Mixed Holding Company

Controls subsidiaries plus also runs some of its operations.

How to Set Up a Holding Company?

Here is the step-by-step process for how to start a holding company.

Step 1: Choose a Business Name

Just like any other business, you need to pick a unique name for your company. Make sure it’s different from other registered names in the UK & fits your brand well.

Step 2: Register the Company with Companies House

To form your holding company, register it with Companies House (the official registrar in the UK). You can do this online or by post but.

You’ll need:

- Company name

- Registered office address

- Director’s details

- Shareholder information

- SIC Code (use: 64209 – Activities of other holding companies)

Registration takes 24 hours online.

Step 3: Decide the Corporate Group Structure

Decide how your holding company will connect with its subsidiaries.Because it affects management, decision-making, and revenue distribution.

Ask yourself:

- Will the holding company own 100% of each subsidiary?

- Will there be multiple share classes (A, B, C)?

- Will you have external investors in the holding company?

- How will profit flow between companies?

A clear structure helps with tax planning, control, and exit strategies.

Step 4: Appoint Directors & Shareholders

The same people can manage both the holding company and subsidiaries or you can assign different directors depending on responsibilities.

Step 5: File Necessary Documents & Register for Taxes

Once incorporated: You need to file all necessary documents so your company follows all the tax laws.

- Register for Corporation Tax

- Register for VAT (if applicable)

- Set up PAYE if you have employees

Even if the holding company does not trade, it still has filing responsibilities.

Step 6: Get a Business Bank Account

A holding company must have its own business account. This will help handle funds and other financial transactions. Separate banking from subsidiaries helps in clear records of inter-company loans, dividends, and expenses. This is essential for compliance and bookkeeping.

When Should I Set Up a Holding Company?

Holding companies have many advantages related to tax efficiency and asset management but here are some key points that will clarify who should be considering holding company structure.

- Should have multiple businesses

- Thinking to expand, start franchising or selling business in the future.

- Own property and assets that you want to protect from trading and operational risks.

If you have these things in mind then you can get in touch with Reflex accounting. You are just one step away from professional services.

Advantages of a holding company

Setting up a holding company has countless advantages, especially for UK businesses. Here are some key points.

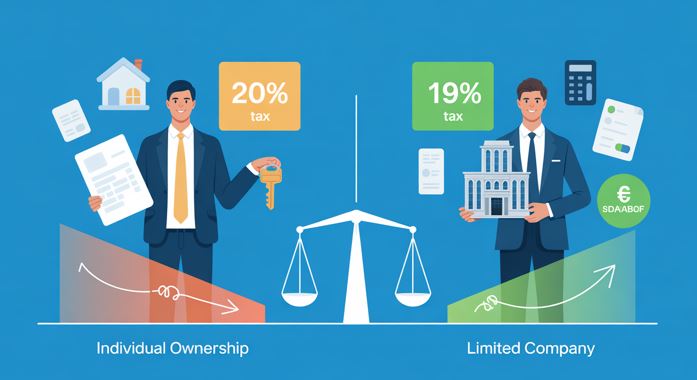

1. Tax Efficiency (Keep more of your money legally)

Holding company structure brings following tax savings:

- Group relief can be availed which means that losses in one subsidiary within a group can be offset against profits from other subsidiaries in order to reduce the overall tax liability at group level.

- Dividends paid from a subsidiary to the holding company is often tax-free as it is exempt from corporation tax.

- A holding company has a capital gain tax relief if the criteria for Substantial Shareholding Exemptions (SSE) is fulfilled.

This means you can transfer money around without any heavy tax. This optimises cashflow and helps in reinvestment and business growth.

2. Asset Protection (Your valuable things stay safe)

A holding company keeps important assets like property, cash, or trademarks separate from trading entities. So if one of your trading companies loses money or faces litigation, your valuable assets are not affected. They stay protected and secure.

3. Simplified Management (Easier to run multiple businesses)

If you run different companies, putting them all under one holding company makes things more organised. Each business can focus on what it does best, while the holding company looks after the big decisions, overall strategy, and long-term planning.

4. Diversification (Try new ideas without risking everything)

A holding company lets you run different businesses in different industries. If one company doesn’t perform well, it does not pull the others down with it. This helps entrepreneurs explore and experiment ideas.

5. Centralised Management (More control from one place)

You can manage all your businesses from one central company.

This helps you make decisions faster, keep branding consistent, and share resources (like marketing, finance, HR) across all your businesses.

6. Easier Financing Options (Banks trust group companies more)

Banks often prefer lending to holding companies because they own several businesses and assets.

They can attract potential investors at the group level making acquisition, scaling and expanding easier. This spreads the risk, making lenders feel more secure meaning it may be easier to get loans or investment.

7. Exit and succession Planning (People buy a part of your group easily)

Establishing a holding company gives you the freedom to sell or transfer parts of the group structure to others. As one subsidiary can be sold separately from the group without impacting other companies in the group.

You can set up companies in a different industry and experiment, sell and keep working. This corporate structure attracts buyers and gives different options to sell your business or to transfer your wealth to the next generation.

Examples of Holding Companies

You might be shocked that UK biggest companies use holding structure for better operation and control.

Here are some of the examples:

1. Unilever PLC

Unilever PLC acts as a parent holding company, owning multiple subsidiaries across personal care, food, and household products.

Brands like Dove, Knorr, Lynx, Magnum, and Hellmann’s are each operated under separate legal entities.

This structure reduces risk, improves tax efficiency, and simplifies global expansion.

2. Diageo

Diageo functions as a holding company that owns and controls various alcohol brands and their operating subsidiaries.

Its portfolio includes Guinness, Johnnie Walker, Smirnoff, Baileys, each run independently in different countries.

The holding structure allows Diageo to manage assets, copyrights, and intellectual property separately.

3. Virgin Group

Virgin Group is a classic example of a diversified holding company, owning stakes in businesses from aviation to banking.

Subsidiaries like Virgin Atlantic, Virgin Media O2, Virgin Money, and Virgin Active operate independently with their own management teams.

This model allows Virgin to experiment in new industries without exposing the entire group to financial losses.

Tax-Efficient Holding Company Structure

A tax-efficient holding company minimizes its tax liabilities while remaining compliant with UK law. Here are some key points given.

Subsidiary Dividends:

Usually, dividends from subsidiaries to UK’s holding companies are tax-exempt. Making profit sharing option attractive.

Group Relief:

Holding companies may also take advantage of group relief, losses from one subsidiary can offset profits in another.

Capital Gains Tax:

Substantial shareholding exemption (SSE) helps avoid capital gains taxes when selling shares in subsidiaries sometimes.

Conclusion

Setting up holding a company may offer major gains including tax benefits alongside streamlined operational efficiencies among several others. Whether SME or promising entrepreneurs, the structure can help future-proof your operations and open the door to new financing opportunities. However, careful planning and a clear understanding of UK laws are crucial to making the most of your company.

How Reflex Accounting Can Help

Once your holding company is set up, the real work begins such as keeping accurate records, managing intercompany transactions, and staying compliant with HMRC.

As specialist accountants for limited companies, we support holding company owners through following services:

Personal tax planning: We help shareholders manage dividend income, capital gains, and personal tax obligations through our personal tax accounting services.

Bookkeeping: Our bookkeeping services keep intercompany loans, dividends, and management charges properly recorded and audit-ready.

VAT advice: If your companies are VAT-registered or considering VAT registration, our VAT accountants ensure correct treatment across entities.

Get in touch for a free consultation.

Faqs

Is a Holding Company Structure Suitable for Startups and Small Businesses?

For small businesses

It can protect valuable assets and streamline management if you own multiple ventures.

For startups:

It’s a great option for future-proofing your business. By creating separate entities for different functions, you reduce risk and make it easier to attract investors.

What does a holding company do?

What is the difference between a holding company and a trading company?

Trading Company: Performs everyday business operations (sales, services, etc.).

What are the common assets a holding company has?

Shares of other companies

Intellectual property (IP)

Property and real estate

Cash reserves

Investments