Running a Limited Company gives you more control over how you get paid. While a regular salary provides consistency, dividends often provide tax efficiency but many business owners still wonder:

What are dividends? How often are dividends paid? Can you pay dividends monthly? And do you pay tax on dividends from your Limited Company?

Let’s break it all down clearly so you can make informed financial decisions and stay compliant with HMRC.

Before we dive deeper, this blog is perfect for you if:

-

- You run a UK Limited Company

-

- You want to know how often dividends are paid

-

- You’re unsure whether you can pay dividends monthly

-

- You want clarity on how often you can take dividends from your company in the UK

-

- You want to understand whether you pay tax on dividends from your Limited Company

-

- You want a simple, compliant way to pay yourself tax-efficiently

-

- You want to avoid illegal dividends or HMRC issues

What are dividends?

Dividends are payments that a limited company pays to their shareholders based on the share ownership. They are not business expenses, they are distribution of profits. So if you own 100% of the limited company, you can take the full dividend amount (as long as the company can afford it).

In the same way, if you have 2 shareholders then each of the shareholders will get 50% of the available profits in the form of dividend. Dividends are easy to distribute in small companies but as the company grows and starts sharing different types of shares, the process becomes complex.

How often are dividends paid?

There’s no legal limit on how often dividends can be paid. In the UK, you can pay dividends as often as your company has available profits whether that’s monthly, quarterly, or annually.

However, most companies choose to pay dividends quarterly or annually, aligning with their accounting or financial review cycles.

This approach allows you to:

-

- Review accurate profit figures before declaring dividends

-

- Avoid overpaying yourself (and risking an illegal dividend)

-

- Simplify bookkeeping and record-keeping

That said, some directors do take dividends monthly, treating them as a form of regular income but that requires careful planning.

The right approach to take dividends from the Limited company to be tax efficient is to use a combination strategy.

-

- A small monthly salary (to stay tax-efficient and protect benefits)

-

- Dividends every quarter or bi-annually, once profits are confirmed

This method balances cash flow, tax efficiency, and compliance.

Do all companies pay dividends?

No, not all pay dividends, only companies with share capital give dividends.

Limited by guarantee companies, private unlimited companies formed without share capital, or any type of partnership will never issue dividends.

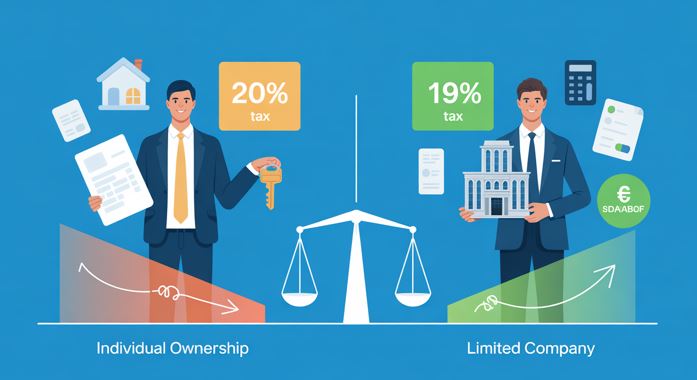

Do I pay tax on dividends from my limited company?

Yes, you do pay tax on dividends if it exceeds a certain amount, but the rates are lower than income tax on a salary because it is paid from retained profits after tax.

No tax is payable on income from dividends that falls within the shareholder’s annual Personal Allowance of £12,570.

Here’s how dividend tax works for the 2025/26 tax year (subject to updates from HMRC):

-

- £500 Dividend Allowance ( You pay no tax on the first £500 of dividend income)

-

- 8.75% on dividends in the basic rate band. (annual income up to £50,270)

-

- 33.75% on dividends in the higher rate. (annual income between £50,271 and £125,140)

-

- 39.35% on dividends in the additional rate band. (annual income above £125,140)

Mistakes Business Owners can avoid taking dividends in the UK

Even though dividends are one of the most tax-efficient ways to pay yourself, many business owners accidentally break HMRC rules without realising it. Here are the most common mistakes you should avoid:

1. Taking Dividends Without Checking Available Profits

Many directors withdraw money assuming the business “should” have profit, but unless you review your actual retained earnings, the dividend may be illegal.

Illegal dividends can be reclaimed during an HMRC review and you may need to repay them personally.

2. Treating Dividends Like a Monthly Salary

Yes, you can pay dividends monthly, but only if the company genuinely has the profit each time.

Most owners take money regularly without doing the profit check and this can trigger personal tax charges.

3. Not Creating Dividend Vouchers or Board Minutes

HMRC requires proper documentation for every dividend declared:

-

- Board meeting minutes

-

- Dividend voucher

-

- Updated bookkeeping records

Skipping these steps is one of the most common compliance issues.

4. Confusing Dividends With Director’s Loans

If the company doesn’t have profits, but you still take money, it becomes a director’s loan, not a dividend. Loans overdrawn for too long trigger Section 455 tax at 33.75% a painful penalty most owners don’t know about.

5. Taking Dividends to Cover Personal Expenses

Paying for personal items directly from the business account and calling it a “dividend” can become messy.

This leads to:

-

- Incorrect bookkeeping

-

- Overdrawn director loan accounts

-

- Incorrectly declared dividends

Always withdraw dividends to your personal account, then pay personal expenses.

6. Paying Dividends When the Company Has Debt

You must consider cash flow even if you technically have retained profit.

A dividend that weakens the company’s financial stability may cause cash flow issues later.

7. Taking Illegal dividends

There is a difference between retained profit and cash in a bank. If you take dividends when the company has no retained profits is an “Illegal dividend”

Final Thoughts

So how often are dividends paid?

As often as your business can afford them!

You can pay dividends monthly, quarterly, or yearly, but make sure your company has enough post-tax profits each time.

And yes, you do pay tax on dividends from your Limited Company, but the rates are lower than income tax, making dividends one of the most efficient ways to pay yourself.

Plan ahead, keep proper records, and combine dividends with a modest salary to stay compliant and financially secure.

Want help to pay yourself in the most tax efficient way from your Limited Company?

At Reflex Accounting, we specialise in helping business owners master cash flow, profit distribution, and strategic tax planning so you can grow with confidence.

Contact us now for personalised services.